Major operations disruptions caused by the COVID-19 pandemic and resulting economic effects could lead to higher education institutions needing to provide enhanced disclosures in their financial statements. While the requirement will vary based on an organization’s unique business risks and circumstances, these changes will likely impact public and private institutions of all sizes.

Major operations disruptions caused by the COVID-19 pandemic and resulting economic effects could lead to higher education institutions needing to provide enhanced disclosures in their financial statements. While the requirement will vary based on an organization’s unique business risks and circumstances, these changes will likely impact public and private institutions of all sizes.

Below is an overview of frequently asked questions (FAQs) in response to how financial reporting under either Financial Accounting Standards Board (FASB) or Governmental Accounting Standards Board (GASB) rules may be impacted by the COVID-19 pandemic. If an accounting standard below differs between FASB and GASB, the article will make that distinction.

1. If an organization operates on the calendar year-end, do changes introduced by the COVID-19 pandemic affect its 2019 financial statements?

Most organizations that report on a US generally accepted accounting principles (GAAP) basis and haven’t issued their December 31, 2019, financial statements will likely need to include additional disclosures, and may also need to incorporate changes introduced by COVID-19 into their recorded balances.

These disclosures are critical to letting the reader know how events following year-end may impact their year-end balances or disclosures. In addition to subsequent event disclosures that would likely be included, disclosures related to risks and uncertainties and changes to estimates may also be necessary. These are addressed below.

Subsequent Events

Subsequent events are defined as events or transactions that occur after the balance sheet date, but before financial statements are issued or are available to be issued. The types of subsequent events are as follows:

- Recognized subsequent events. These include transactions or events that provide information about conditions or estimates that existed at the date when the company provided its statement of financial position.

- Nonrecognized subsequent events. These consist of events that supply information about conditions that didn’t exist at the date of the balance sheet but arose afterward.

Recognized Subsequent Events

There are a couple ways the COVID-19 pandemic and resulting economic effects may affect conditions that existed at the date of the statement of financial position:

- Impacts to an organization’s financial projections, which are used to assess impairment of a tangible or intangible asset or ability to continue as a going concern

- Assessment of receivables from donors, students, or others, and estimates of the related allowance for doubtful accounts

Nonrecognized Subsequent Events

Impacts of the COVID-19 pandemic will also likely fall under nonrecognized subsequent events, in which case an organization is required to disclose either of the following:

- The nature of the event and an estimate of its financial effect

- A statement that this financial estimate can’t be made

Information to Include

Your organization’s subsequent event disclosures should be clear and transparent, and they should include the following points:

- A general sentence or two describing the nature of the pandemic and the resulting economic impact

- A more specific description of how the outbreak has impacted operations and may impact future operations

- Your organization’s response to the pandemic and its economic impact

- An estimate of the financial effect or a statement that the financial effect can’t be estimated

2. How can an organization document and disclose the impacts of the COVID-19 pandemic on its ability to serve the community, earn revenue, and collect donations?

FASB reporters are required to consider going concern risks, which have traditionally been something an auditor needs to consider.

In August 2014, the FASB introduced a new requirement in GAAP. Accounting Standard Update (ASU) No. 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40) states that management should assess, at each interim and annual reporting period, an entity’s ability to continue as a going concern and provide related disclosures in certain circumstances. This change went into effect for annual reporting periods beginning after December 15, 2016.

The requirement for GASB reporters to consider going concern risks, described in GASB Codification Section 2250, is less specific but still requires some efforts, especially in light of the current environment. Section 2250 also specifies the disclosures required in the event of substantial doubt about a government’s ability to continue as a going concern.

As a result, your organization is likely already performing this analysis as part of its normal financial close and reporting cycle.

Regardless of whether you’re a GASB or FASB reporter, your auditor may request additional information or inquire about your assessment of the impact of the COVID-19 pandemic to check your compliance with GAAP, and also to help satisfy their requirement to consider going concern risks.

Ceasing Operations

If the COVID-19 pandemic is negatively impacting your organization to the point where it needs to cease operations, or will have difficulty paying its obligation as they come due, the pandemic would likely be considered an event or circumstance that raises substantial doubt about your organization’s ability to continue as a going concern.

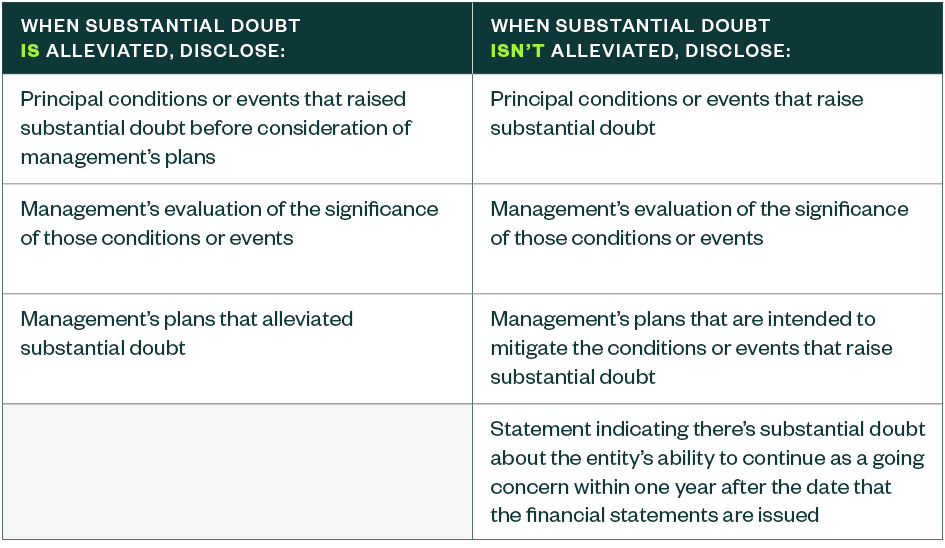

These circumstances would require you to evaluate management’s plans to mitigate the substantial doubt in connection with your financial close and reporting cycle. Depending on the effectiveness of your risk-mitigation plans—which could include opportunities that arose out of the Coronavirus Aid, Relief, and Economic Security (CARES) Act—your organization may require additional disclosures.

Here’s an overview of what those might include:

3. Does an organization need to disclose additional risks and uncertainties the COVID-19 outbreak introduced to its operations?

Your organization’s domestic or international operations could be disrupted by travel restrictions or supply chain disturbances. If you’re a FASB reporter, ASC 275-10-50, Risks and Uncertainties, applies to your organization.

It primarily relates to disclosure of risks and uncertainties that could significantly affect the amounts reported in financial statements in the near term or the near-term functioning of the reporting entity.

GASB reporters would look to GASB’s underlying Concepts Statements and individual topic areas for guidance. Financial reporting may need to include narrative explanations about the underlying assumptions and uncertainties inherent in an estimation or measurement process, and considerations about uncertain future events.

Vulnerability from Concentrations

Vulnerability from concentrations in, for example, financial assets, suppliers, geographic areas, or sources of income arises because an entity is exposed to risk of loss greater than if it mitigated its risk through diversification.

Under GAAP, specifically for FASB reporters, entities are required to disclose the concentrations in their financial statements if all of the following criteria are met:

- The concentration exists at the date of the financial statements.

- The concentration makes the entity vulnerable to the risk of a near-term severe impact.

- It’s reasonably possible that events that could cause severe impact will occur in the near term.

GASB’s requirements related to disclose risks from concentrations are more specific to individual topic areas, such as concentrations from credit risk. An organization should disclose information about concentrations that can adequately inform users of the general nature of the risk associated with them, including the effects of the COVID-19 pandemic, as applicable.

4. How could these changes affect Schedule of Expenditures of Federal Awards (SEFA) reporting and single audits?

Currently, there’s no direct impact to the SEFA or SEFA footnotes for years ended December 31, 2019. However, in March and April 2020, the Office of Management and Budget (OMB) issued four memos to federal agencies that provide flexibility specific to COVID-19:

- First memo (M-20-11). This directs federal agencies to provide waivers and extensions for grant recipients performing essential research and services necessary to carry out the emergency response.

- Second memo (M-20-17). This is intended to provide administrative relief to an expanded scope of recipients affected by the loss of operational capacity and increased costs.

- Third memo (M-20-20). This directs all federal departments and agencies to marshal all legally available federal resources to combat the crisis.

- Fourth memo (M-20-21). This provides guidance on implementation of supplemental funding provided through the CARES Act.

Depending on how federal agencies react—specifically federal agencies from which your organization receives funds—additional disclosures could be required in future periods to ensure amounts presented on the SEFA are clear and transparent.

CARES Act

The CARES Act provides significant additional funding opportunities for not-for-profit organizations as well as state and local governments. The federal agencies were directed to rapidly deliver the funds to COVID-19 relief and response efforts. Because the funds were rushed to be delivered, federal agencies and the OMB are now working to establish controls and reporting around the funding.

We’re Here to Help

Requirements and relief initiatives related to the COVID-19 pandemic are continuously changing. To learn more about the above requirements and how to accurately disclose your organization’s financial circumstances, contact your Moss Adams professional.